NEW CASTLE, DELAWARE, UNITED STATES, October 13, 2023 /EINPresswire.com/ — Invoice factoring can assist business owners in overcoming the time between the creation of an invoice and the actual payment by the client. Moreover, invoice factoring is an alternative form of financing that is available to businesses that may not have an established banking record with a major lender.

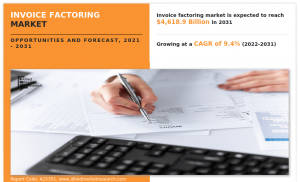

According to a new report published by Allied Market Research, titled, “Invoice Factoring Market,” The invoice factoring market was valued at $1946.51 billion in 2021, and is estimated to reach $4618.9 billion by 2031, growing at a CAGR of 9.4% from 2022 to 2031.

Download Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/15720

Furthermore, major market players are undertaking various strategies to increase the competition and offer enhance services to their customers. For instance, in July 2020, American Express and SAP Concur recently announced two digital integrations to help businesses streamline and automate invoicing and expenses. This first offering is an integration that allows American Express Business and Corporate Card customers to integrate with Concur Invoice. This tool uses machine learning to capture both digital and paper invoices. And then it integrates them into a single system.

The global invoice factoring market is analyzed across segments such as type, application, enterprise size, provider, industry vertical, and region. The report takes in an exhaustive analysis of segments and their sub-segments with the help of tabular and graphical representation. Investors and market players can benefit from the breakdown and devise stratagems based on the highest revenue-generating and fastest-growing segments stated in the report.

Based on type, the resource factoring segment contributed to nearly three-fourths of the global market revenue in 2021, and is expected to dominate by 2031. The same segment would also showcase the fastest CAGR of 10.3% throughout the forecast period. The non resource factoring segment is also discussed in the study.

By application, domestic segment garnered the highest share in 2021, generating more than four-fifths of the global market. The international segment, on the other hand, would project the fastest CAGR of 12.8% from 2022 to 2031.

Request Customization@ https://www.alliedmarketresearch.com/request-for-customization/15720

By enterprise size, the large enterprises segment held more than two-thirds of the total market revenue in 2021, and is expected to dominate by 2031. The small and medium sized enterprises segment, at the same time, would manifest the fastest CAGR of 11.5% throughout the forecast period.

By provider, the banks segment garnered more than three-fourths of the total market share in 2021, and is anticipated to rule the roost by 2031. The NBFCs segment, simultaneosuly, would showcase the fastest CAGR of 12.7% throughout the forecast period.

Based on region, the market across Europe generated more than two-thirds of the total market revenue in 2021, and is anticipated to retain the lion’s share by 2031. The Asia-Pacific region, however, would display the fastest CAGR of 13.9% during the forecast period. The other regions studied in the report include North America and LAMEA.

The key market players analyzed in the global invoice factoring market report include Porter, Adobe, Barclays Bank UK PLC, ICBC, Intuit Inc., American Express Company, and Lloyds Bank. These market players have embraced several strategies including partnership, expansion, collaboration, joint ventures, and others to highlight their prowess in the industry. The report is helpful in formulating the business performance, product portfolio, operating segments, and developments by the top players.

Key benefits for stakeholders

• This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the invoice factoring market outlook from 2021 to 2031 to identify the prevailing invoice factoring market opportunities.

• The market research is offered along with information related to key drivers, restraints, and opportunities.

• Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

• In-depth analysis of the invoice factoring market segmentation assists to determine the prevailing market invoice factoring market opportunity.

• Major countries in each region are mapped according to their revenue contribution to the global market.

• Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

• The report includes the analysis of the regional as well as global invoice factoring market trends, key players, market segments, application areas, and market growth strategies.

Inquiry before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/15720

Key Market Segments

Type

• Recourse Factoring

• Non-recourse Factoring

Application

• Domestic

• International

Enterprise Size

• Large Enterprises

• Small and Medium-sized Enterprises

Provider

• Banks

• NBFCs

Industry Vertical

• Construction

• Manufacturing

• Healthcare

• Transportation and Logistics

• Energy and Utilities

• IT and Telecom

• Staffing

• Others

By Region

• North America (U.S., Canada)

• Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

• Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

• LAMEA (Latin America, Middle East, Africa)

Top Trending Reports:

ATM Market: https://www.alliedmarketresearch.com/automated-teller-machine-ATM-market

Neo and Challenger Bank Market: https://www.alliedmarketresearch.com/neo-and-challenger-bank-market

Direct Carrier Billing Platform Market: https://www.alliedmarketresearch.com/direct-carrier-billing-platform-market

AI in BFSI Market: https://www.alliedmarketresearch.com/artificial-intelligence-in-BFSI-market

Asia-Pacific Travel Insurance Market: https://www.alliedmarketresearch.com/asia-pacific-travel-insurance-market

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high-quality data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

![]()

Originally published at https://www.einpresswire.com/article/661670689/at-cagr-of-9-4-invoice-factoring-market-2022-global-industry-expected-to-grow-and-forecast-to-2031