Banks and credit unions win primary financial institution status with Swaystack’s gamified onboarding and engagement platform in Q2 Digital Banking.

Financial Institutions can now provide gamified onboarding and personalized engagement to customers through Q2’s Digital Banking Platform

— Har Rai Khalsa, CEO & Co-founder of Swaystack

MIAMI, FL, UNITED STATES, September 24, 2024 /EINPresswire.com/ — Swaystack, a gamified onboarding switch kit and personalized engagement platform, is proud to announce its integration with Q2’s Digital Banking Platform, via the Q2 Partner Accelerator Program. Q2 Holdings, Inc. (NYSE: QTWO) is a leading provider of digital transformation solutions for banking and lending. As part of the Q2 Partner Accelerator Program, financial institutions will be able to purchase Swaystack and then offer gamified onboarding and personalized engagement via the Q2 Digital Banking Platform, to tackle the 44% of newly opened accounts that go inactive within the first year.

The Q2 Partner Accelerator is a program through the Q2 Innovation Studio that allows in-demand financial services companies who are leveraging the Q2 Software Development Kit (SDK) to pre-integrate their technology to the Q2 Digital Banking Platform. This enables financial institutions to work with these partners, purchase their solutions and rapidly deploy their standardized integrations to their customers.

“Swaystack is honored to join the Q2 Partner Accelerator program, furthering our mission to help banks and credit unions compete with neobank and megabank personalized onboarding and engagement,” said Har Rai Khalsa, Swaystack’s CEO and Co-founder. “Banks and credit unions face a dual strain: coming out of pocket to acquire account holders, while nearly half of those accounts go inactive. In an effort to win primary financial institution and top of wallet status, we must earn the direct deposit relationship and help consumers put their card on-file with popular merchants.”

What are the primary reasons new accounts go inactive?

• Funding never happens

• Direct deposit never gets set up

• Debit cards are seldom used

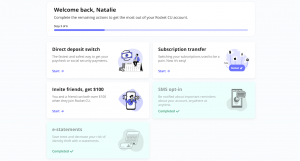

Swaystack’s integration with the Q2 Digital Banking Platform means banks and credit unions can deliver gamified onboarding and personalized engagement day one to deal with the most common challenges that financial institutions face when onboarding new customers:

• Funding: Facilitate immediate funding with Instant Account Verification (IAV)

• Direct Deposit: Switch direct deposit seamlessly by connecting with payroll providers

• Debit Card Usage: Update card-on-file with APIs to popular merchants

To learn more about Swaystack and the Q2 Innovation Studio Partner Accelerator Program, please click here: https://www.q2developer.com/marketplace/apps/swaystack/marketing

About Swaystack

Swaystack, a personalized onboarding and engagement platform, is spearheaded by second-time founders who share a passion for helping banks and credit unions compete with megabank and neobank technology. Har Rai Khalsa began his career as a lender in 2007, co-founded MK Decision in 2015 to help banks and credit unions compete with digital account opening, which was acquired by Alkami in 2021. Simran Singh Co-founded Zogo in 2018. As the CTO of Zogo, he helped 250+ financial institutions gamify financial education to over 1.6 million users. Simran and Har Rai have a collective 20+ years in fintech and have served over 300+ financial institutions with the companies they’ve built. To learn more, schedule a discovery call.

About Q2 Holdings, Inc.

Q2 is a leading provider of digital transformation solutions for financial services, serving banks, credit unions, alternative finance companies, and fintechs in the U.S. and internationally. Q2 enables its financial institution and fintech customers to provide comprehensive, data-driven digital engagement solutions for consumers, small businesses and corporate clients. Headquartered in Austin, Texas, Q2 has offices worldwide and is publicly traded on the NYSE under the stock symbol QTWO. To learn more, please visit Q2.com. Follow us on LinkedIn and X to stay up to date.

Har Rai Khalsa

Swaystack

email us here

Visit us on social media:

X

LinkedIn

Other

Overcoming Onboarding Blind Spots for Banks and Credit Unions

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Originally published at https://www.einpresswire.com/article/745906411/swaystack-announces-integration-with-q2-s-digital-banking-platform